2024 Event Recap

August 15 • Wheaton, IL

Thank You For Attending!

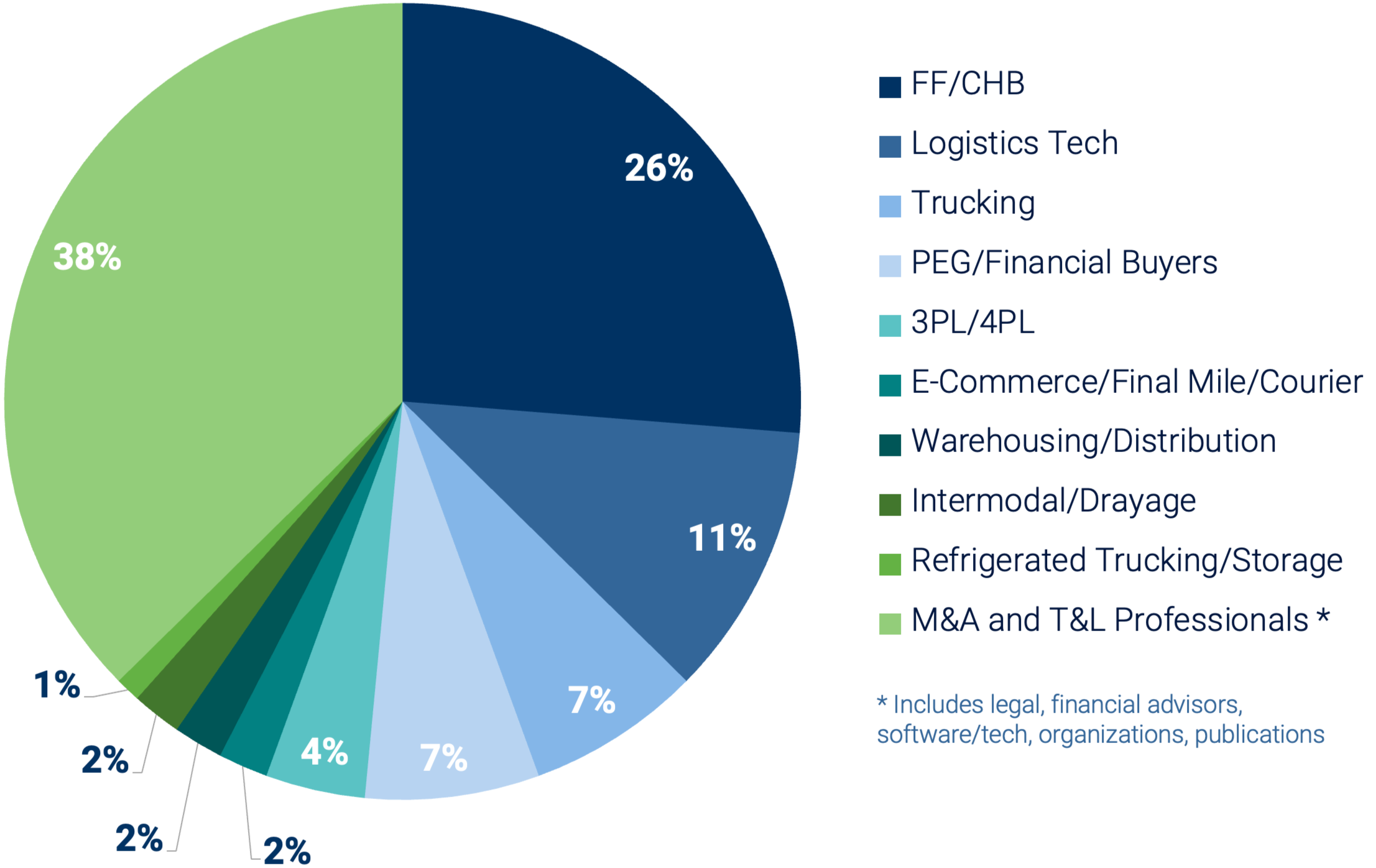

The Logistics M&A Club hosted its 2024 annual event at Cantigny Golf Course in Wheaton, Illinois, bringing together transportation and logistics owners, executives, and industry advisors for a day centered on connection, insight, and collaboration. Despite uncooperative weather, the event delivered a high-quality experience marked by thoughtful conversations, engaging programming, and meaningful relationship-building among leaders navigating growth, consolidation, and strategic change within the logistics sector. The event reinforced our mission of creating a trusted, peer-driven forum for industry leadership.

The Logistics M&A Club extends its sincere thanks to all attendees whose participation and engagement made the event a success. The Logistics M&A Club looks forward to continuing the conversation and welcoming members back for future events.

Video produced by Position:Global

$17,000 For Misericordia Heart of Mercy!

We’re thrilled to announce that through your combined generosity via raffle ticket sales and large donations, our 2024 Logistics M&A Club Event raised $17,000 for Misericordia! Thank you to everyone for supporting this amazing organization!

Thank You to Our 2024 Sponsors!

Photo Gallery

Thank You to Our 2024 Speakers!

Key Discussion Takeaways

-

China has experienced significant growth in the global economy, impacting trade dynamics.

Supply chains need to focus on controlling risks, with key concerns being geopolitical tensions and government interventions (i.e. trade laws, forced labor protections).

Nearshoring is effective in Asia and increasingly adopted in the US with investments in Mexico, but less effective in Europe.

Future international trade will emphasize food over manufactured goods, with an increased focus on sustainability and risk management in shipping.

-

China and Trade Relationships: Companies are exploring alternatives to China, with nearshoring in Asia growing; Mexico is emerging as a viable option, though the transition is slow, and China’s manufacturing dominance remains strong.

Section 321 and Trade Walls: Section 321 is expected to remain in place with anticipated compliance changes, influenced by shifts in administration and market demand.

Mexico and Trade Agreements: Mexico is a viable option despite border complexities and political factors; support for Mexico is strong, though infrastructure development is needed.

COVID-19 and Vertical Integration: The pandemic has led to streamlining logistics to manage costs and adjustments in the market; larger companies will continue to impact the industry.

Consolidation and Trade Impact: Smaller companies face challenges due to consolidation; creativity and consultation are key, and government interference can disrupt free trade.

Future of Logistics M&A: The logistics M&A market is expected to be active in 2025, with a focus on geographic and expertise expansion; private equity involvement is growing, emphasizing non-asset-based businesses.

Pandemic Impact on Valuation: Valuation methods remain largely unchanged, focusing on long-term performance; recent performance drives higher multiples due to scale and innovation.